1. Price Action Trading

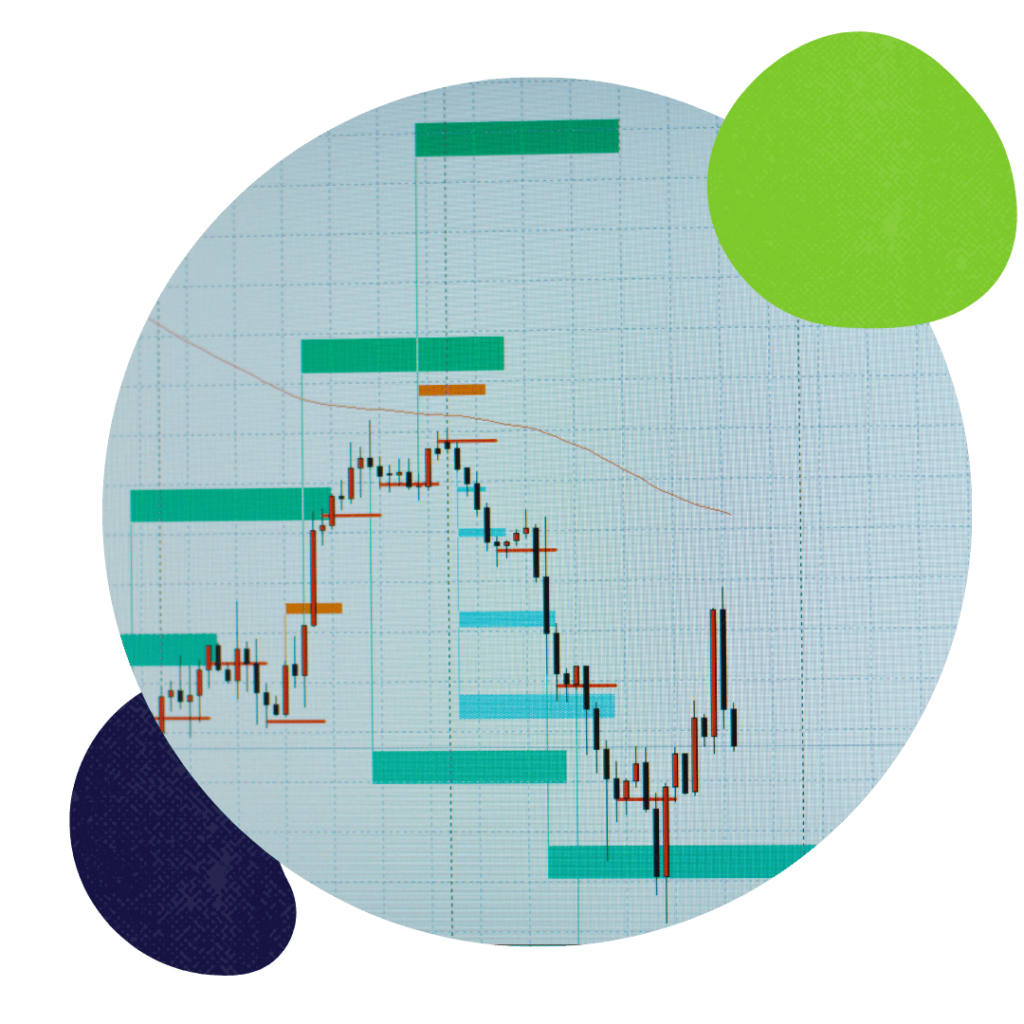

Price Action Trading focuses on the study of historical price movements to make informed trading decisions. Unlike indicator-based strategies, this approach relies purely on reading candlesticks, chart patterns, and key levels. It’s ideal for traders who want to simplify their analysis and understand market psychology.

What You’ll Learn:

Candlestick Patterns

Learn to identify reversal and continuation patterns that reveal market sentiment.

Trend Analysis

Master the skill of detecting bullish, bearish, and sideways market trends.

Support and Resistance

Understand how to pinpoint critical price zones where the market reacts.

Entry and Exit Strategies

Build effective strategies for entering and exiting trades based on price behavior.

Live Practice

Apply your knowledge with real-time market scenarios.

This course will empower you to make confident trading decisions with minimal reliance on external tools. It’s suitable for beginners and experienced traders alike.

2. SMC Core Concepts

Smart Money Concepts (SMC) focuses on institutional trading methods that exploit market inefficiencies. This course delves into the mechanics of how large institutions operate and how you can align your strategies with theirs.

What You’ll Learn:

Liquidity Zones

Discover how institutional traders target areas of liquidity to execute large trades.

Order Blocks

Learn to spot key price zones where institutional activity occurs, giving you a competitive edge.

Market Structure

Understand break of structure (BOS) and change of character (CHoCH) to determine market direction.

Advanced Risk Management

Develop precise trade setups with minimal risk and maximum reward.

This course is perfect for traders looking to elevate their skills and trade with the precision of professionals.

3. Risk Management Techniques

Risk management is the cornerstone of successful trading. This course focuses on strategies to safeguard your investments while maximizing returns. Traders often overlook risk management, but this course ensures it becomes an integral part of your trading plan.

What You’ll Learn:

Position Sizing

Determine the right amount to risk per trade based on your account size.

Stop Loss and Take Profit

Set precise levels to limit losses and lock in gains

Risk-to-Reward Ratios

Learn how to structure trades with favorable risk-reward ratios.

Portfolio Diversification

Spread your investments across different asset classes to minimize risk.

Psychology of Risk Management

Overcome emotional trading and stick to your plan during volatile market conditions.

This course is essential for all traders, regardless of experience level, as it focuses on protecting your capital while ensuring consistent growth.